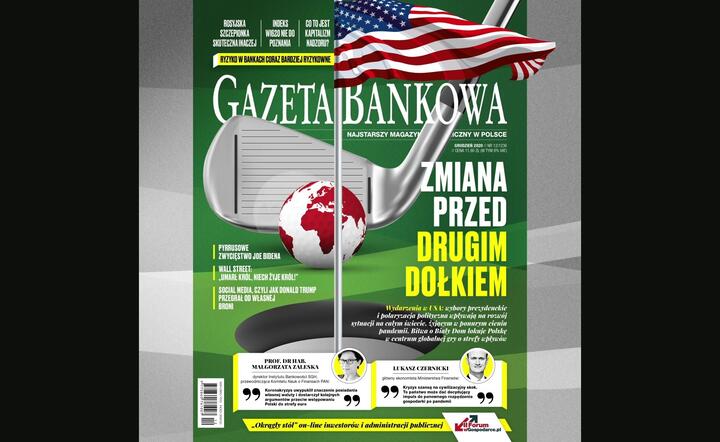

"Gazeta Bankowa": America sneezes, the world has a fever

We all will feel the consequences of the events surrounding the US presidential election - just like the global economy will feel it all over the world. Refferiing to a game of golf, before the second economic bunker, caused by the pandemic, which needs a really good back swing, one of the key players changes - in the December issue Gazeta Bankowa focuses on the economic consequences of the US presidential election. The new edition of the oldest Polish economic monthly on sale from Thursday 26 November

“The shift of power and political polarization are not conducive not olny to stabilizing the situation in the USA itself, but also around the world. The sense of uncertainty is growing, multiplying pessimistic scenarios of the development of the situation in international relations. That multiplies the risks of decisions made in the sphere of the economy. Declining mobility (transport, passenger and air traffic, trade) on the one hand indicates potential progress in the fight against the pandemic, and on the other, it heralds a further deepening of the economic downturn. As consumption and prices of energy are falling, volatility in financial markets increases. The euro area, mired in recession, is once again faced with the nightmare of deflation, while many emerging countries are slipping into stagflation, ie high inflation, with GDP falling. Military conflicts (the conflict between Armenia and Azerbaijan) and rebellions (Ethiopia) are multiplying. The terrorist threat is increasing in Europe. In such a precarious situation, political bodies on both sides of the Atlantic are far from consensus even on the fundamental issue of fighting the economic consequences of the pandemic.” - points out Jerzy Bielewicz in the text named „Joe Biden’s Pyrrhic Victory”.

“The post-election scenario for the US stock market looks like an Alfred Hitchcock’s movie. At the beginning there was an earthquake, and now the tension is only rising, because risk factors multiply, which will result in significant fluctuations in stock prices and strong returns in investor sentiment in the coming months” - writes Krzysztof Pączkowski in his analysis of the US capital market after the elections, titled „The Thriller Of Wall Street”. The author of „Gazeta Bankowa” emphasizes that „We have a deadlock on the adoption of the stimulus package for the US economy after the pandemic, and the dispute between Democrats and Republicans may continue for a long time after the final settlement.”

„He was winning in social media, so he lost in social media. What part you don’t understand?” – provocatively writes Maksymilian Wysocki, managing editor of economic portal wGospodarce.pl, and an experienced social media marketer, in the text called „Electional pork barrel for vegans only” - an extremely interesting analysis of the role of social media in the course of the US presidential election. [For unrealistic election promise in Polish we use a term „electional sausage” – editor]. In. In his opinion: “In the 2020 US election and the presidential race, social media played a role greater than ever. Both candidates have allocated unprecedented amounts of resources and budget to the implementation of their campaign in „social networks” (…) “Donald Trump’s victory in 2016 would not have been possible without Twitter and Facebook. Democrats in 2020 have learned their lesson. (…) Pumped up to the point of absurdity, the Black Lives Matter revolt resulted in a led by corporations-advertisers boycott of especially the strongest and untouchable before Facebook. As a result, for the first time in history, a mass censorship was introduced to social media at the campaign’s decisive point, which affected the conservative part of content in social media, and Trump lost the election. Was that the plan?” – he writes.

“Welcome to a world where the media and journalists settle who becomes the president of the USA. Welcome to a world where Facebook, Twitter and similar services have become the main channels (sic!) of information and opinion distribution. Welcome to a world where the victory of politicians is no longer determined by fiery speeches, courageous clashes during debates, but by a budget allocated to presence in social media. Information rules the world - a simple and hackneyed statement today should be updated with „Only well-distributed information allows you to rule the world today”. Nowdays, much more important than „I know” is a question of „how will I pass it on” and „who will know”. The post-election struggle and its accompanying media fever in the United States has clearly shown that it’s a media path from which turning back is almost imposible.”- summarizes the topic of the American elections Maciej Wośko, editor-in-chief of „Gazeta Bankowa” and wGospodarce.pl, in the editorial titled „Just click „.

“For over a dozen years we have been living in uncertainty, in a permanent crisis, in its subsequent scenes. The current pandemic situation is also characterized by very high uncertainty. The development of the situation is so dynamic that all forecasts bear a high risk of error„- says Prof. Małgorzata Zaleska, director of the Institute of Banking of the Warsaw School of Economics, chairman of the Financial Sciences Committee of the Polish Academy of Sciences, correspondent member of the Polish Academy of Sciences, former president of the WSE in an interview with Grażyna Raszkowska. “The world has become addicted to having central banks pushed money into markets. We need to stop calling quantitative easing a non-standard action. It is already a standard instrument of monetary policy, which has been used systematically by the largest central banks in the world for several years. In addition, the world has become dependent on the low interest rates, which may increase in the future. The consequences of this policy, i.e. the adoption of increasingly risky instruments on central banks’ balance sheets, and the „blown up” government securities market may become the source of another global version of the financial crisis. An interesting issue is also how the world will deal with the rapidly growing debt in the future. Will there be a reduction of debts by the mighty of this world? The answer to this question is fundamental, among others in the context of actions taken to combat the effects of the coronavirus. Moreover, the current situation clearly shows that we should be prepared „for everything” in the future and modify the existing risk maps. „

The subject of risk for the banking sector in Poland is taken up by Piotr Rosik in the text „More risky risks”. “The pandemic forces banks to modify risk management. The elements of uncertainty are not diminishing at all. The sector has to deal with it, although probably not everyone will come out of this clash unscathed” he declares. „There is no doubt that the ongoing pandemic has already affected banks’ risk management activities and their current credit and financial policy, and thus affects their profitability.” - writes Rosik and emphasizes: „banks must be aware of the structural changes in the economy caused by the pandemic: reducing the role of services and increasing the role of production activities and redefining the directions of consumption.”

Łukasz Czernicki, Chief Economist of the Ministry of Finance, titles his comment „Crisis as a chance for a civilization leap”. According to a columnist for Gazeta Bankowa, „it is the state that can give the decisive impulse to re-accelerate the economy after the pandemic.” The Chief Economist of the Ministry of Finance states, inter alia: “Exiting the pandemic will require the mobilization of significant public funds to stimulate the activity of the private sector. High uncertainty about the future (including the necessary restrictions in movement or restrictions in running a business) will limit private investments, and some entrepreneurs will resign from developing their businesses. Well-thought-out public investments should activate the economy and create a basis for its growth. ”.

In the text „WIG20 beyond recognition”, Piotr Rosik points out that „Allegro was included in the WIG20 index in October. This may be the beginning of a series of changes which in the next few months will make this most important index on the Warsaw Stock Exchange attract more foreign capital. WIG20 from the banking, telecom and energy index has a chance to become a highly diversified index, with a large share of the so-called new economy „. “The presence of companies from the broadly understood technology industry in the most important Polish stock exchange index is good news for both the stock exchange and investors. When FTSE Russell included the Warsaw Stock Exchange among the developed markets, there were voices that this was an exaggerated decision, since the core of WIG20 are banks and raw materials companies, and meanwhile there should be more technology companies. This is what is happening. Allegro’s debut meant that companies from the so-called of the new economy are responsible for over 1/3 of the WIG20 portfolio, and the combined capitalization of the two largest - CD Projekt and Allegro - exceeds PLN 120 billion” - Marek Dietl told Gazeta Bankowa. - “The entry of new technology companies to this index will further strengthen the position of the WSE as a place to raise capital for real unicorns from Central and Eastern Europe. On the other hand, it will allow investors to gain more profits by investing in large entities from the most prosperous sectors of the economy” Dietl added in an interview with Piotr Rosik.

In the current issue of Gazeta Bankowa, also read a report from the on-line round table of government administration, business and investors as part of the summary of the 2nd edition of the wGospodarce.pl Forum.

In the latest issue of „Gazeta Bankowa” we will also read about the fact that Warsaw is becoming a global data collection center, about the German business sadness related to the pandemic, about how Vladimir Putin plays with promises about a Russian vaccine against COVID-19, for which game producers need retired KGB agents, how HR departments change in the realities of the pandemic and how much and to whom Polish banks pay in the IT specialists industry.

„Gazeta Bankowa” - the oldest economic magazine in Poland: current events in the world of economy and finance in the country and in the world, people and companies, investments and the world of technology, history of the Polish economy.

New issue of „Gazeta Bankowa” monthly on sale from Thursday 26 November, also in the form of e-edition. Details on http://www.gb.pl/e-wydanie-gb.html

The new issue of Gazeta Bankowa is also available in mobile app stores:

Google Play (Android): CLICK HERE

Apple App Store (iOS): CLICK HERE

Huawei AppGallery (Huawei): CLICK HERE

MORE: CLICK HERE

Dziękujemy za przeczytanie artykułu!

Pamiętaj, możesz oglądać naszą telewizję na wPolsce24. Buduj z nami niezależne media na wesprzyj.wpolsce24.